The Terrible Tariffbull & TradFi’s Blockchain Embrace

Welcome readers! We’re going to start this month by noting that October has been, among the crypto crowd, affectionately known as “Uptober” for many, many years. This is, of course because historically October is a month which brings outsized crypto gains, particularly at this point in our cycle. This Uptober however, not so much, as for the first time in seven years we saw a down October, with BTC itself finishing the month down roughly 4%. Why did this happen, well, markets are markets but I do have some thoughts...

A Tariffbull October

It all started so well. “Uptober” was off to the races, with markets surging and striving and growing at a huuuuuge pace in the beginning of the month. In the midst of a government shutdown the crypto markets followed bitcoin, perceived as a safe haven, with big gains. In fact, many super-bullish traders were using leverage to take advantage of the expected month of gains (Ahem - In the film industry this is called “foreshadowing”.)

Then… October 10th. This day will go down in history as the single biggest day of crypto market losses to date. It started not-so-innocently enough with Trump announcing a 100% tariff on Chinese imports of software and tech, which basically freaked everyone out, leading to our “Tariffbull.” So, what the heck is a “Tariffbull”? We were in a bull run. We had this tariff announcement. The impact of these tariffs inside of this bull run is, exactly that… “Tariffbull.” (You’re welcome). Whatever you call it, it sure seems that this event led to pullbacks in the markets which then – you guessed it from earlier foreshadowing - triggered leveraged positions which were caught with surprise. Automated Forced liquidations opened the door to a cascading effect of levered positions getting capital calls which in turn drove markets deeper in the hole and… you get the idea. At the end of the day we had a flash crash with approximately $19B (yes B as in Billions) in forced liquidations.

Bitcoin dropped 14% intraday, with some altcoins dropping 33% in the first 25 minutes before falling in some cases 50%–70% before recovering. A falling knife indeed.

UnBear-able

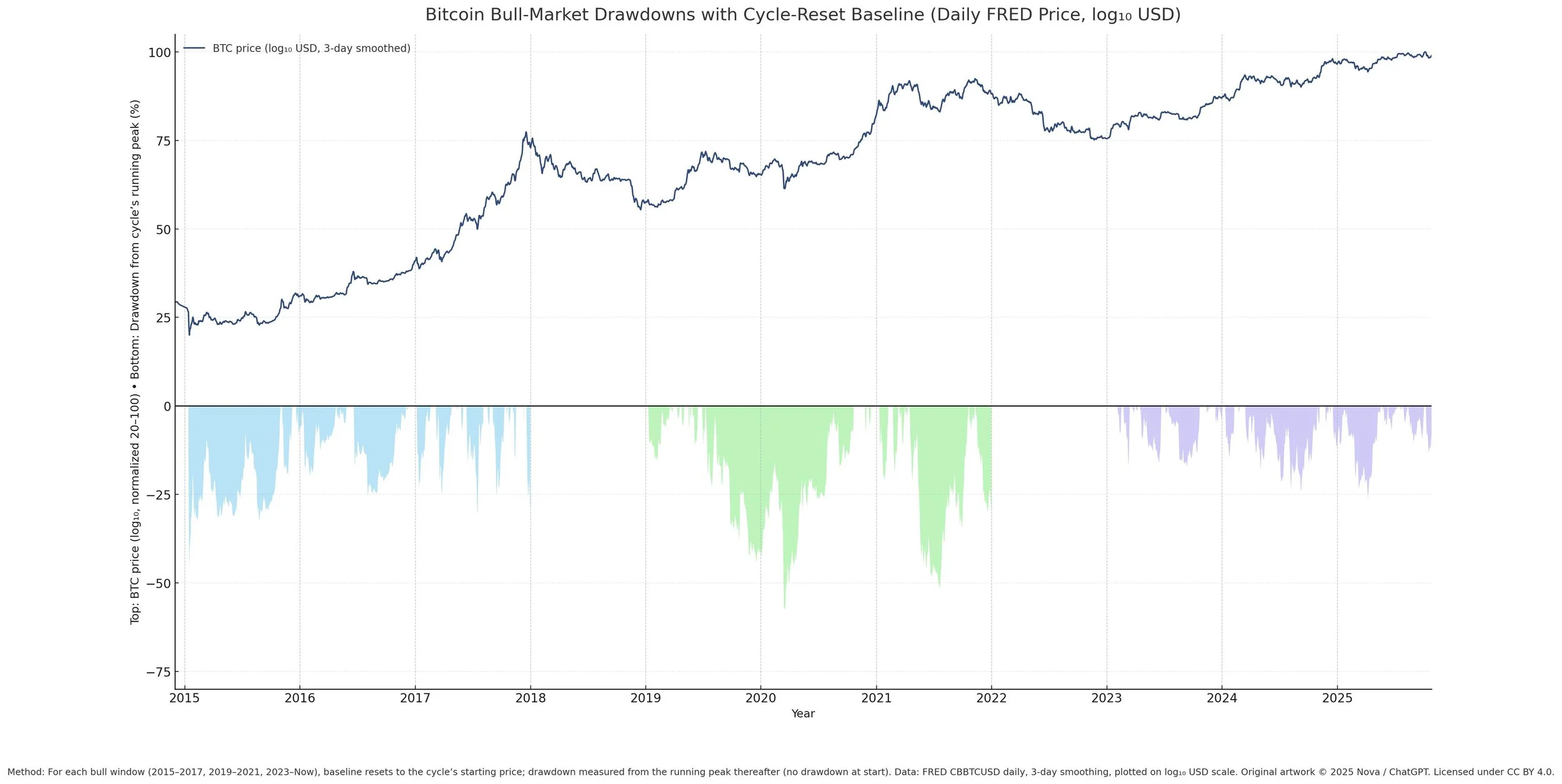

Of course, this led to many calling this the end of the bull run. Naysayers were quick to proclaim that the cycle has topped, the bear was beginning, the sky was falling, cats and dogs were fornicating and the Earth was near its end. Well, for those of you for whom this is NOT your first cycle I assume you were just enjoying your popcorn, because we’ve been here before. I remember very clearly March 13, 2020 where a similar deleveraging event occurred in the middle of a bull run. And guess what happened about eight weeks later? Yup, full recovery and then some. We have to keep perspective. This was an exogenous event caused by a political announcement that triggered automatic liquidations, and my opinion is that the markets will recover. Maybe November. Maybe December. But I believe we’ll get there (and then some!) The tariff issue seems to be resolved, but now the government shutdown isn’t helping. Bitcoin is tightly correlated to liquidity, and our government shutdown is causing a liquidity crisis so, we have yet another delay in the key metric we watch. But that’s OK. Crypto is a game of patience and we have to understand… for as much as we love those parabolic gains, nothing ever goes up in a straight line. As a frame of reference, and readers from past cycle have heard this before, we generally have 5–10 pullbacks in a bull run that range from 10% to 50%. A simple summary of it is as follows, which shows Bitcoin’s price over time vs the colored bars, demonstrating intra-bull downdrafts, often ranging from 20% to even 50% (data from FRED).

For those who want more information on this Glassnode has a wealth of data on this and a pretty neat chart to boot.

The punchline here is that I remain bullish. Does that mean I think you should lever up? Did you see what happened on Oct 10? NO, I do NOT recommend that you use leverage to buy crypto. In a market with so much upside in front of us there’s just no need. We just cut rates and expect more cuts. Liquidity is expanding worldwide. The business cycle is opening up. And according to our interpretation of market data, we’re nowhere near tops. Everything from my view is that this has just been pushed out and will take a little longer and once the government is no longer shut down we expect our regularly-scheduled run to resume. Just mind the noise and perhaps if you have the means and some spare liquidity, take advantage of where we are and this pullback, because in my opinion, we remain in the period with the best risk/reward we have ever seen in these markets.

Tradfi goes Defi

Price action is what gets everyone’s attention. But I’ll harken back to one of my standards and remind everyone that all crypto enabled by blockchain technology, and the integration of this technology into our world by companies, governments and institutions is the thing that’s going to fundamentally change the way we operate. To that end, the venerable company Mastercard put a bid out to acquire crypto startup Zerohash for… nearly $2 billion. Yes, that’s billion with a “B.” This is a function of Mastercard really getting in the stablecoin game (which, as you know, are crypto assets that are directly tied to the U.S. Dollar.) Now, Zerohash is an infrastructure company that facilitates payments and trading particularly in the stablecoin space but, perhaps more importantly, it goes beyond stablecoins. Zerohash also facilitates tokenization of traditional assets, which alludes to the fact that Mastercard might have their eyes on a much bigger game. Just as BlackRock has been vocal about wanting to tokenize securities, beginning with the tokenization of ETFs, it seems that Mastercard may also want some of this pie. Regardless, whether stablecoin enablement or more, this kind of adoption is happening quietly and under the radar and, in my perspective, is the real thing that is going to drive these markets over time. When companies that are rooted in the world of traditional finance start to embrace companies that are espousing a whole new technology, the message is clear. Blockchain is the direction things are going. And, you’ve heard me say this before, it’s much easier to ride a horse in the direction it is going than to fight it. Apparently Mastercard is riding, not fighting.

blockchAIn

Finally, this month let’s take a look at another way blockchain and AI are advancing to create a new foundational layer for business. As you may know, Ripple, the institutional remittance platform, has been making waves in the cross-border payments world, shooting across the bow at incumbent SWIFT by gathering banks that want to implement their technology. Well, apparently SWIFT took notice because it seems they are expanding their collaboration with blockchain oracle Chainlink, integrating the Chainlink “Cross-Chain Interoperability Protocol” (CCIP) and going live in November of this year, creating a foundational layer for banks to use blockchain technology to (ta-da!) facilitate cross-border payments. This will move them one step closer to being able to fend off, or at least compete with, the formidable Ripple/XRP network. It also dovetails into their efforts in blockchain collaborating with AI to facilitate the creation of ISO 20022 compliant records for transmission across its network. It adds another arrow to their quiver, and is the next step of progress inside of Swift’s mandate to create own blockchain based ledger for cross border payments. With 30 global banks in testing phases including BofA, HSBC and BNP Paribas, and their CCIP integration going live, it’s clear that the payment wars are stepping up. Who will win? Ripple? Swift? Both? Neither?

I argue it doesn’t really matter. What is important here is that Blockchain infrastructure is being adopted, AI is assisting with compliance and readiness and, just as noted above with Mastercard, the traditional finance world is continuing to take steps and get “blockchainified.” It seems that SWIFT as well is also “riding the horse in the direction it’s going.” It’s going blockchain.

In Closing

No one ever said the crypto markets were boring, and “Uptober” bucked the trend this year by not being up at all. That’s OK. The backdrop is still set for our biggest legs yet this cycle in the crypto markets. Perhaps more importantly, we’re seeing more and more blockchain adoption happening by industry incumbents. What used to be innovators and fringe players now has been embraced by the old guard. It will take time for this technology to be fully set into our daily infrastructure but, at the end of the day, that’s where it is going to end up. And that, in my opinion, is the greatest market driver of all.

That’s all for now. Until next time be well, stay safe, and I’ll keep Decrypting Crypto for you!